Thank you for visiting this Endowment page.

Planned Giving, also called Legacy giving, is an important part of any Christian's support of a church's ongoing ministry.

At Good Shepherd, we have four Endowment funds (listed below) for this kind of stewardship. Please review this information and prayerfully consider what type of endowment gift you feel called to make.

If you have any questions, please contact one of the Endowment Board members or call Good Shepherd at (828)743-2359.

The Conkle-Rowe Scholarship Endowment Fund

Over five decades, Henry Conkle and Pat Rowe have demonstrated “Our Faith in Action” with their passion and commitment to supporting local students seeking post-secondary education. The impact to our community is immeasurable. Unlike other institutions that award scholarships, we endeavor to follow our students until they graduate. Click here to learn more about the Conkle-Rowe Scholarship Endowment Fund.

The Shepherd Endowment Fund

Established in 1999, this restricted fund is to meet the human needs and outreach in Cashiers and the surrounding area.

The Second Century Endowment Fund

Established in 1995 on the 100th anniversary of our historic church building, this fund is designed to care for our historic property. “Celebrating Our Past; Preparing for Our Future”.

The Hines Hall Endowment Fund

The Hines Hall Endowment Fund was established in 2013 to support, maintain and protect Hines Hall, which is a focal point for a myriad of activities in our church community. Hines Hall is in use every day of the week and is a vital and welcoming environment for all aspects of our parish life.

Hines Hall houses our administrative offices, several classrooms, a kitchen, the great hall, library, choir room and two smaller meeting rooms on the main level. Our lower level is the strategic staging area for donations heading to the Bazaar Barn. The great hall can accommodate approximately 200 people depending on its intended configuration and is also used for worship service overflow, our annual meeting, multiple weekly meetings, movie night, Bible and Lectionary studies, parish meal gatherings, Sunday School, the church nursery, and all sorts of special events. Additionally, Hines Hall offers space for many groups in our community including Cashiers Cares and The International Friendship Center, as well as broader educational programs such as English Language Learner classes.

The Hines Hall Endowment currently has a balance of approximately $180,000. In the last six months we have replaced the roof of Hines Hall as well as all eight of the HVAC units. We will need to build up this fund over the next few years as several more major expenses are anticipated, including updating the Audio/Visual systems and replacing the acoustical ceiling tiles.

If you are interested in making a gift or bequest, contact Ellen Albright at:

Phone: 828-743-2359

Email: [email protected]

Endowment Board Members:

Tom Treichel, Lisa Dargan, Vic Brandt, Bev Seinsheimer, Jim Recktenwald.

Ex Officio:

Rob Wood | Rector

Irv Welling | Finance Chair

Peter Keck | Senior Warden

Fred Halback | Junior Warden

Over five decades, Henry Conkle and Pat Rowe have demonstrated “Our Faith in Action” with their passion and commitment to supporting local students seeking post-secondary education. The impact to our community is immeasurable. Unlike other institutions that award scholarships, we endeavor to follow our students until they graduate. Click here to learn more about the Conkle-Rowe Scholarship Endowment Fund.

The Shepherd Endowment Fund

Established in 1999, this restricted fund is to meet the human needs and outreach in Cashiers and the surrounding area.

The Second Century Endowment Fund

Established in 1995 on the 100th anniversary of our historic church building, this fund is designed to care for our historic property. “Celebrating Our Past; Preparing for Our Future”.

The Hines Hall Endowment Fund

The Hines Hall Endowment Fund was established in 2013 to support, maintain and protect Hines Hall, which is a focal point for a myriad of activities in our church community. Hines Hall is in use every day of the week and is a vital and welcoming environment for all aspects of our parish life.

Hines Hall houses our administrative offices, several classrooms, a kitchen, the great hall, library, choir room and two smaller meeting rooms on the main level. Our lower level is the strategic staging area for donations heading to the Bazaar Barn. The great hall can accommodate approximately 200 people depending on its intended configuration and is also used for worship service overflow, our annual meeting, multiple weekly meetings, movie night, Bible and Lectionary studies, parish meal gatherings, Sunday School, the church nursery, and all sorts of special events. Additionally, Hines Hall offers space for many groups in our community including Cashiers Cares and The International Friendship Center, as well as broader educational programs such as English Language Learner classes.

The Hines Hall Endowment currently has a balance of approximately $180,000. In the last six months we have replaced the roof of Hines Hall as well as all eight of the HVAC units. We will need to build up this fund over the next few years as several more major expenses are anticipated, including updating the Audio/Visual systems and replacing the acoustical ceiling tiles.

If you are interested in making a gift or bequest, contact Ellen Albright at:

Phone: 828-743-2359

Email: [email protected]

Endowment Board Members:

Tom Treichel, Lisa Dargan, Vic Brandt, Bev Seinsheimer, Jim Recktenwald.

Ex Officio:

Rob Wood | Rector

Irv Welling | Finance Chair

Peter Keck | Senior Warden

Fred Halback | Junior Warden

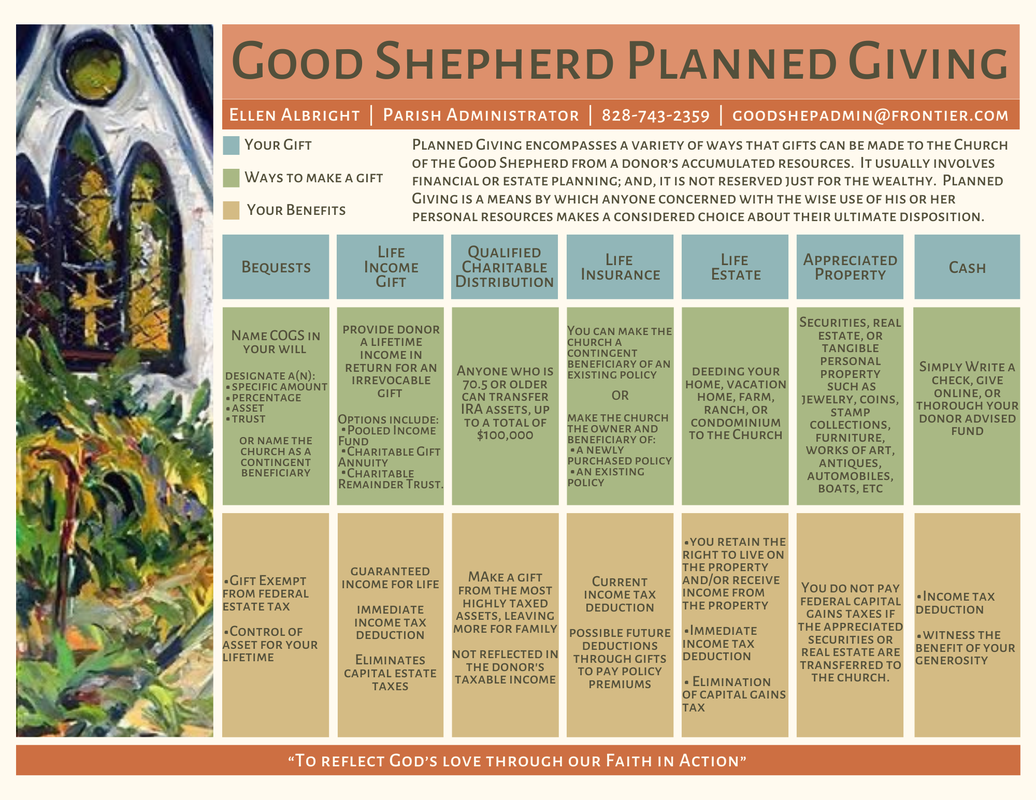

Understanding Planned Giving and the different ways an individual, estate, or trust can make a gift or designation.

Planned Giving encompasses a variety of ways that gifts can be made to the Church of the Good Shepherd from a donor’s accumulated resources. It usually involves financial or estate planning; and, it is not reserved just for the wealthy. Planned Giving is a means by which anyone concerned with the wise use of his or her personal resources makes a considered choice about their ultimate disposition.

In general, Planned Giving is made through Wills or Codicils and can include:

1. A Bequest in a Will or in a Codicil

Perhaps the easiest and the most common way of making a planned gift is through your will. A bequest in a will can take the form of a set amount of money, a certain percentage of an estate, a specific asset, a trust, or the naming of the church as a contingent beneficiary.

2. Life Income Gifts

Life Income Gifts provide the donor a lifetime income in return for an irrevocable gift. These gifts may be established in several ways, the most common of which include the Pooled Income Fund, the Charitable Gift Annuity, and the Charitable Remainder Trust.

In the Pooled Income Fund, gifts ($2,500 minimum) are “pooled” with other gifts and invested in a professionally managed portfolio. The donor receives the following benefits:

The benefits of establishing a Charitable Gift Annuity are similar to that of the Pooled Income Fund with the following differences:

Unlike the Pooled Income Fund, this gift may be “reinsured” by a life insurance company that will agree to pay you an income for life and provide the church with an immediate cash gift. This cash payout for the gift portion of the annuity will be considerably less than if the church waited until the death of the donor.

A Charitable Remainder Trust usually involves larger sums of money ($100,000 or more) and is individually managed. Like the Pooled Income Fund and the Charitable Gift Annuity, the Charitable Remainder Trust provides income for life, an income tax deduction, relief from capital gains taxes (if funded through appreciated property), and a possible reduction in state taxes.

A Charitable Remainder Trust can be added to over the years, and a portion of the Trust can be set aside for growth as a hedge against inflation. The rate of return fluctuates based on the performance of the portfolio. If you are seeking a set rate of return annually, a Charitable Remainder Annuity Trust is an option to consider.

3. Qualified Charitable Distribution (QCD) - The QCD is available to traditional IRA owners over age 70 1/2 who are subject to a Required Minimum Distribution (RMD) for which they have no need for the funds. Currently, the QCD limit is $100,000 in any calendar year. Distributions must be paid to qualified 501(c)3 organizations, which includes churches. Donor advised funds don't qualify.

The benefit is that the RMD is not reflected in the donor's taxable income which is normally the case. However, if one itemized deductions, the QCD cannot be claimed as a deduction.

4. Gifts of Life Insurance

Life Insurance is a popular and convenient way to make a sizable gift to the church when the policies are paid in full and the church is named as the owner and beneficiary. For example:

Also, you can use life insurance in conjunction with another planned gift. For example, you can purchase life insurance with the income received from a life insurance trust, thus replacing, and in some instances, surpassing, the principal removed from the estate by the gift.

5. A Gift of Life Estate

Another way of making a planned gift is by deeding your home, vacation home, farm, ranch, or condominium to the Church of the Good Shepherd.

Through a Charitable Life Estate contract, you retain the right to live on the property and/or receive income from the property for as long as you or your beneficiary lives.

You receive an income tax deduction when the property is deeded to the church, avoid any capital gains taxes when making the transfer, and your inheritance and

estate taxes may be reduced at the time of your death.

6. Gifts of Appreciated Property

Securities, real estate, or tangible personal property can be an excellent means of making a gift to the Church of the Good Shepherd.

You do not pay federal capital gains taxes if the appreciated securities or real estate are transferred to the church. Normally, the value of the shares for gift and tax purposes is the fair market value, not the original purchase price.

It is important to transfer the stock or real estate to the church prior to selling it. However, if securities or real estate have decreased in value, you should sell the assets before making the gift, thus establishing a capital loss and a potential tax deduction.

Gifts of tangible personal property, such as jewelry, coins, stamp collections, furniture, works of art, antiques, automobiles, boats, etc., may be given to the church. You are responsible for setting an appraised value on the gift. The IRS requires the independent appraisal of any gift over $5,000.

As you consider your Planned Giving, the Church of the Good Shepherd clergy and members of the Endowment Fund Board would be happy to talk with you. However, we are not able to render legal or tax advisory service. For advice and assistance in specific cases, the services of an attorney or other professional advisors should be obtained.

Information in this booklet has been provided by Episcopal Church Foundation.

Planned Giving encompasses a variety of ways that gifts can be made to the Church of the Good Shepherd from a donor’s accumulated resources. It usually involves financial or estate planning; and, it is not reserved just for the wealthy. Planned Giving is a means by which anyone concerned with the wise use of his or her personal resources makes a considered choice about their ultimate disposition.

In general, Planned Giving is made through Wills or Codicils and can include:

- A Bequest .

- A Life Income Gift, such as a Pooled Income Fund, a Charitable Gift Annuity, or a Charitable Remainder Trust.

- A Qualified Charitable Distribution (QCD).

- Life Insurance.

- A Life Estate such as a gift of a home, farm or ranch.

- Appreciated Property such as real estate or securities.

- Outright gifts of cash.

1. A Bequest in a Will or in a Codicil

Perhaps the easiest and the most common way of making a planned gift is through your will. A bequest in a will can take the form of a set amount of money, a certain percentage of an estate, a specific asset, a trust, or the naming of the church as a contingent beneficiary.

2. Life Income Gifts

Life Income Gifts provide the donor a lifetime income in return for an irrevocable gift. These gifts may be established in several ways, the most common of which include the Pooled Income Fund, the Charitable Gift Annuity, and the Charitable Remainder Trust.

In the Pooled Income Fund, gifts ($2,500 minimum) are “pooled” with other gifts and invested in a professionally managed portfolio. The donor receives the following benefits:

- A guaranteed income for life. The amount of the income depends on the rate of return on the fund’s investments. The income can also flow to a surviving, or other designated beneficiary.

- An immediate federal income tax deduction. The amount of the deduction is usually based on the age of the donor and/or beneficiaries.

- The elimination of capital gains taxes, if funded through appreciated securities such as stocks, bonds, mutual funds, or real estate.

- A possible reduction in estate taxes.

- At the death of the final beneficiary, the gift goes to the church.

The benefits of establishing a Charitable Gift Annuity are similar to that of the Pooled Income Fund with the following differences:

- The income for life is guaranteed at a fixed rate.

- Some of the income received may be tax exempt.

- The minimum gift is $5,000.

Unlike the Pooled Income Fund, this gift may be “reinsured” by a life insurance company that will agree to pay you an income for life and provide the church with an immediate cash gift. This cash payout for the gift portion of the annuity will be considerably less than if the church waited until the death of the donor.

A Charitable Remainder Trust usually involves larger sums of money ($100,000 or more) and is individually managed. Like the Pooled Income Fund and the Charitable Gift Annuity, the Charitable Remainder Trust provides income for life, an income tax deduction, relief from capital gains taxes (if funded through appreciated property), and a possible reduction in state taxes.

A Charitable Remainder Trust can be added to over the years, and a portion of the Trust can be set aside for growth as a hedge against inflation. The rate of return fluctuates based on the performance of the portfolio. If you are seeking a set rate of return annually, a Charitable Remainder Annuity Trust is an option to consider.

3. Qualified Charitable Distribution (QCD) - The QCD is available to traditional IRA owners over age 70 1/2 who are subject to a Required Minimum Distribution (RMD) for which they have no need for the funds. Currently, the QCD limit is $100,000 in any calendar year. Distributions must be paid to qualified 501(c)3 organizations, which includes churches. Donor advised funds don't qualify.

The benefit is that the RMD is not reflected in the donor's taxable income which is normally the case. However, if one itemized deductions, the QCD cannot be claimed as a deduction.

4. Gifts of Life Insurance

Life Insurance is a popular and convenient way to make a sizable gift to the church when the policies are paid in full and the church is named as the owner and beneficiary. For example:

- You can purchase a new policy and make the church the owner and beneficiary of the policy. This enables you to “leverage” your gift, ultimately making a much larger gift than otherwise possible. Premiums become tax deductible.

- You can make the church the owner and beneficiary of an existing policy. The current value of the policy is tax deductible, as are future premium payments.

- You can make the church a contingent beneficiary of an existing policy, i.e., name the church to receive the proceeds of the policy if the designated beneficiaries predecease the insured.

Also, you can use life insurance in conjunction with another planned gift. For example, you can purchase life insurance with the income received from a life insurance trust, thus replacing, and in some instances, surpassing, the principal removed from the estate by the gift.

5. A Gift of Life Estate

Another way of making a planned gift is by deeding your home, vacation home, farm, ranch, or condominium to the Church of the Good Shepherd.

Through a Charitable Life Estate contract, you retain the right to live on the property and/or receive income from the property for as long as you or your beneficiary lives.

You receive an income tax deduction when the property is deeded to the church, avoid any capital gains taxes when making the transfer, and your inheritance and

estate taxes may be reduced at the time of your death.

6. Gifts of Appreciated Property

Securities, real estate, or tangible personal property can be an excellent means of making a gift to the Church of the Good Shepherd.

You do not pay federal capital gains taxes if the appreciated securities or real estate are transferred to the church. Normally, the value of the shares for gift and tax purposes is the fair market value, not the original purchase price.

It is important to transfer the stock or real estate to the church prior to selling it. However, if securities or real estate have decreased in value, you should sell the assets before making the gift, thus establishing a capital loss and a potential tax deduction.

Gifts of tangible personal property, such as jewelry, coins, stamp collections, furniture, works of art, antiques, automobiles, boats, etc., may be given to the church. You are responsible for setting an appraised value on the gift. The IRS requires the independent appraisal of any gift over $5,000.

As you consider your Planned Giving, the Church of the Good Shepherd clergy and members of the Endowment Fund Board would be happy to talk with you. However, we are not able to render legal or tax advisory service. For advice and assistance in specific cases, the services of an attorney or other professional advisors should be obtained.

Information in this booklet has been provided by Episcopal Church Foundation.

"CREATING ONE’S LEGACY"

Recordings of interactive workshops about legacy giving.

August 6, 2020 - Dr. Rodney Tucker regarding medical decisions

August 13, 2020 - Eric Toole regarding legal decisions

August 20, 2020 - The Rev. Rob Wood - making choices for your funeral

Some of the best gifts a person can give family members include the directives for medical, legal, and spiritual wishes in case one becomes very ill or dies. These issues are not easy to think about, and even less easy to talk about, but having one’s affairs in order creates a peace of mind for all involved.

To help people think through what can be complicated and difficult choices, the Good Shepherd Endowment Board sponsored three sessions entitled, “Creating One’s Legacy.” These three presentations took place on August 6, 13, and 20. Each session is approximately an hour. Please enjoy the recordings below as well as the documents that are referenced in the sessions.

To help people think through what can be complicated and difficult choices, the Good Shepherd Endowment Board sponsored three sessions entitled, “Creating One’s Legacy.” These three presentations took place on August 6, 13, and 20. Each session is approximately an hour. Please enjoy the recordings below as well as the documents that are referenced in the sessions.

The Endowment Committee primarily oversees the distribution of Endowment funds as requested or needed and communicates the needs of the endowments to parishioners and creates pathways for people to make charitable legacy gifts.

Email [email protected] for more information.

Email [email protected] for more information.

The Episcopal Church of the Good Shepherd

The Episcopal Diocese of Western North Carolina

Good Shepherd's Mission Statement

“To reflect God’s love through our Faith in Action”

“To reflect God’s love through our Faith in Action”

|

Mailing Address:

P.O. Box 32 Cashiers, NC 28717 Address: 1448 Highway 107 South Cashiers, North Carolina 28717 Contact Ellen Albright, Parish Administrator Phone: 828-743-2359 Fax: 828-743-9138 Email: [email protected] |

Directions:

From the intersection of US 64 and NC 107 in Cashiers, NC, we are 1.5 miles south on NC 107, on the right, and across the street from the entrance to High Hampton Inn. |